Nickel One Announces Final Drill Results from the Tyko Project, including 1.47% Nickel over 6.05m and 4.71% Nickel over 0.87m

Vancouver, British Columbia (FSCwire) - Nickel One Resources Inc. (“Nickel One” or the “Company”, TSXV:NNN) announces the second round of drilling results on its 100%-owned, Tyko Nickel-Copper-Platinum Group Element (“Ni-Cu-PGE”) Project near Marathon in northwestern Ontario. This second round of results comprises drill holes TK-16-005 through 014 (Table 1). Significant results include:

- TK-16-006: 1.03% Ni over 13.42m.

- TK-16-010: 1.06% Ni over 6.22m, including 4.71% Ni over 0.87m.

- TK-16-011: 1.47% Ni over 6.05m, including 2.12% Ni over 3.15m.

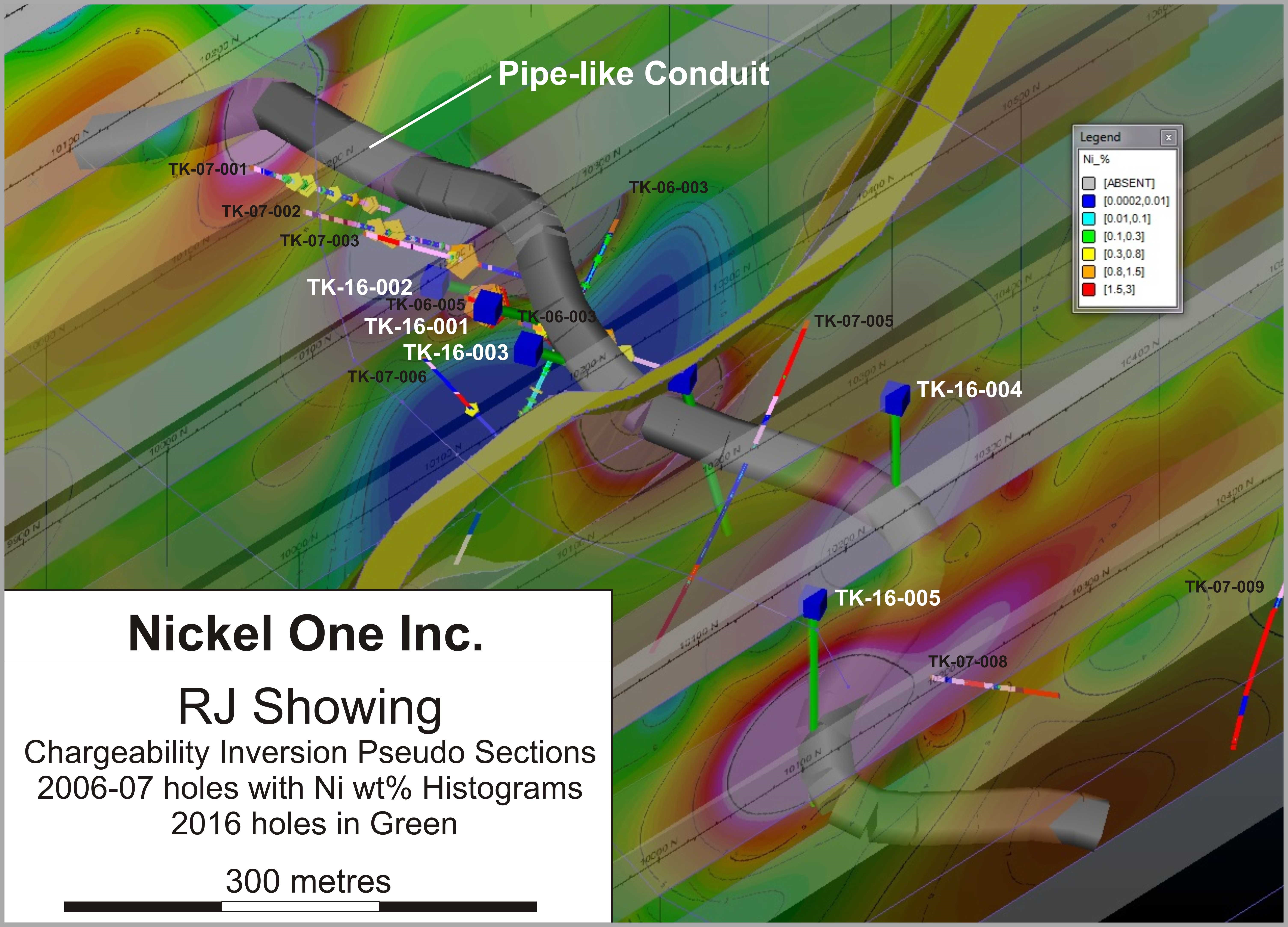

Nickel One’s President and CEO, Vance Loeber commented: “We are extremely encouraged by assays from the recent drilling program on the Tyko Zone that significantly exceed historic results. The Project continues to showcase considerable grade potential. The new results support the magma conduit model, developed by Fladgate Exploration Consulting, and previously tested at the RJ Occurrence. Initial results support this model which potentially links the RJ and Tyko zones (separated by 1.5km) as part of pipe-like feeder system”.

As with the RJ Zone, the Tyko Zone consists primarily of metamorphosed mineralized pyroxenite which has been intruded by later granitoid rocks. The mineralized pyroxenite contains abundant rip-up clasts of other mafic-ultramafic phases indicative of an active feeder-type system (Figures 1 and 2). The mineralization is nickel-rich with an average Ni:Cu ratio of ~2:1 and a Pt:Pd ratio of ~1:1. Sulphides consist of pyrrhotite-pyrite-pentlandite-millerite-chalcopyrite and are typically disseminated to blebby with local patches of net-textured and semi-massive sulphide breccia.

The sulphide tenors of the Ni-Cu-PGE mineralization on the Tyko Property are very high. Total sulphur analysis completed by Nickel One indicated tenors in 100% sulphide that average 8.6% Ni, 4.6% Cu, and 3.3g/t PGE at the RJ Zone and 16.3% Ni, 8.70% Cu, and 12.8g/t PGE at the Tyko Zone.

The high tenor of the sulphide suggests a high value flotation concentrate from RJ or Tyko style mineralization. This indicates that even a disseminated sulphide deposit could potentially be economic and adds further support to the view that Nickel One’s 100% owned Tyko Project contains a fertile magmatic feeder system. The Company’s objective is to delineate this feeder system and ultimately develop a mineral resource on the Property.

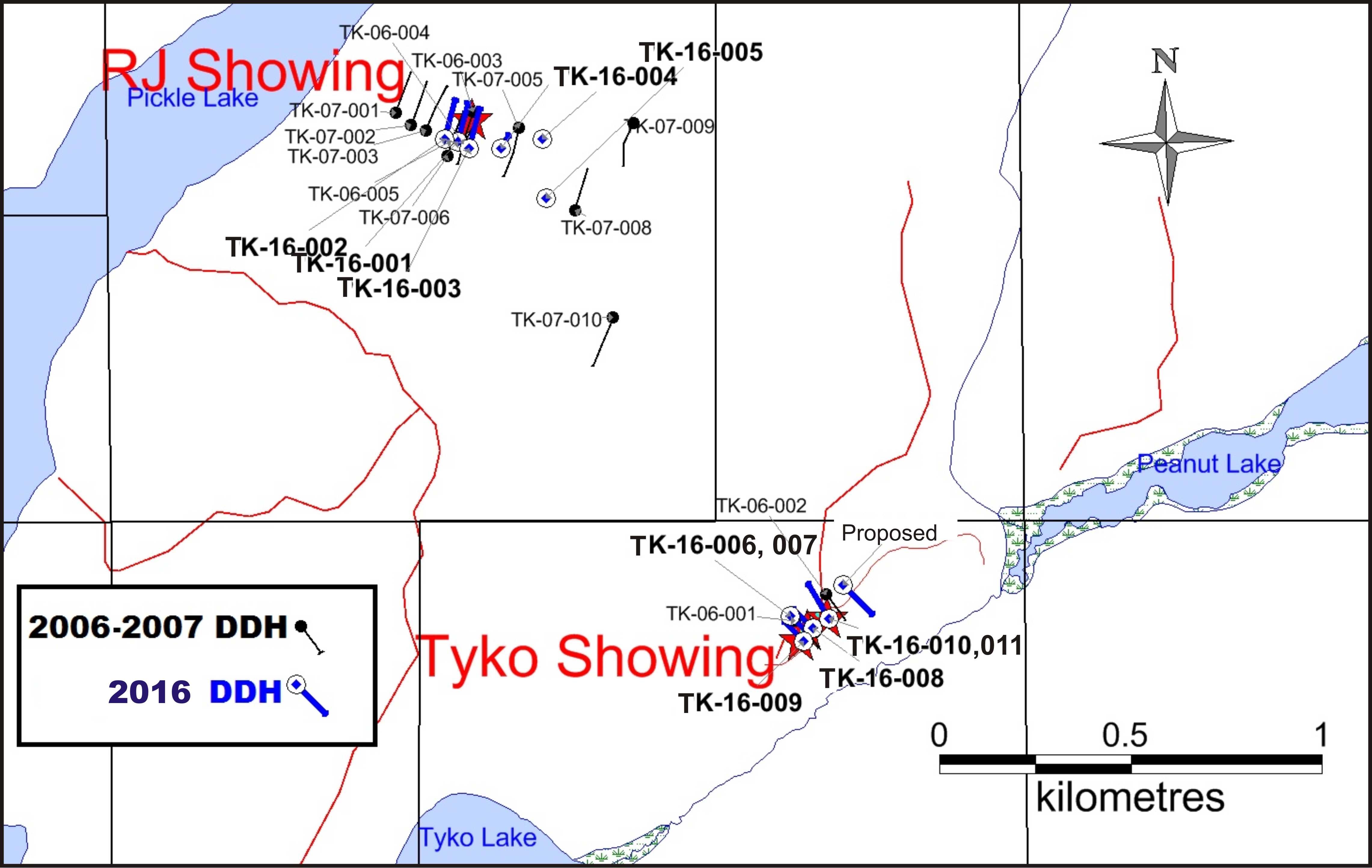

The current update includes final results from an additional 1200 metres of drilling in 10 holes out of a total of 1780 metres in 14 holes on the 2016 drilling program that targeted the RJ and Tyko zones (Figure 2). A third target, termed the “Bruce Lake Anomaly”, was also tested which interested ultramafic rocks with anomalous nickel values.

Table 1: Composite Weighted Average Assay Intervals, Tyko Project, Q2/2016 Drilling

|

Hole No. |

Zone |

From m |

To m |

Length m |

Ni wt% |

Cu wt% |

Au ppm |

Pt ppm |

Pd ppm |

Total PGE ppm |

|

TK-16-001* |

RJ Zone |

3.60 |

92.50 |

88.90 |

0.26 |

0.14 |

0.01 |

0.04 |

0.04 |

0.09 |

|

Sub Zone |

7.65 |

14.26 |

6.61 |

0.54 |

0.27 |

0.02 |

0.15 |

0.09 |

0.26 |

|

|

Sub Zone |

19.70 |

23.70 |

4.00 |

0.51 |

0.34 |

0.02 |

0.06 |

0.05 |

0.13 |

|

|

Sub Zone |

32.50 |

42.09 |

9.59 |

0.62 |

0.28 |

0.01 |

0.07 |

0.08 |

0.16 |

|

|

Including |

37.90 |

42.09 |

4.19 |

0.89 |

0.35 |

0.01 |

0.08 |

0.09 |

0.19 |

|

|

Including |

37.90 |

39.00 |

1.10 |

1.67 |

0.56 |

0.03 |

0.14 |

0.16 |

0.33 |

|

|

Including |

37.90 |

38.50 |

0.60 |

2.31 |

0.88 |

0.05 |

0.16 |

0.22 |

0.43 |

|

|

TK-16-002* |

RJ Zone |

15.00 |

100.42 |

85.42 |

0.52 |

0.23 |

0.01 |

0.10 |

0.09 |

0.21 |

|

Sub Zone |

23.69 |

26.14 |

2.45 |

0.94 |

0.25 |

0.01 |

0.23 |

0.24 |

0.49 |

|

|

Including |

24.85 |

25.48 |

0.63 |

2.05 |

0.37 |

0.03 |

0.58 |

0.52 |

1.13 |

|

|

Sub Zone |

35.00 |

37.00 |

2.00 |

0.53 |

0.23 |

0.03 |

0.15 |

0.15 |

0.33 |

|

|

Sub Zone |

52.75 |

96.87 |

44.12 |

0.79 |

0.30 |

0.01 |

0.12 |

0.11 |

0.24 |

|

|

Including |

58.25 |

66.50 |

8.25 |

1.04 |

0.54 |

0.01 |

0.12 |

0.12 |

0.26 |

|

|

Including |

66.00 |

66.50 |

0.50 |

2.89 |

0.45 |

0.01 |

0.27 |

0.35 |

0.63 |

|

|

And |

77.65 |

93.84 |

16.19 |

1.04 |

0.23 |

0.00 |

0.15 |

0.12 |

0.28 |

|

|

Including |

78.62 |

90.00 |

11.38 |

1.23 |

0.26 |

0.00 |

0.18 |

0.13 |

0.32 |

|

|

Including |

82.00 |

83.00 |

1.00 |

1.97 |

0.19 |

0.00 |

0.17 |

0.12 |

0.29 |

|

|

TK-16-003* |

RJ Zone |

2.47 |

99.26 |

96.79 |

0.18 |

0.11 |

0.00 |

0.02 |

0.02 |

0.05 |

|

Including |

2.47 |

38.20 |

35.73 |

0.29 |

0.17 |

0.01 |

0.03 |

0.04 |

0.07 |

|

|

Including |

24.97 |

25.91 |

0.94 |

0.72 |

0.35 |

0.00 |

0.07 |

0.14 |

0.21 |

|

|

Including |

30.00 |

30.70 |

0.70 |

0.82 |

0.24 |

0.00 |

0.08 |

0.08 |

0.16 |

|

|

TK-16-004* |

RJ Zone |

92.50 |

97.10 |

4.60 |

0.26 |

0.13 |

0.00 |

0.02 |

0.03 |

0.06 |

|

Including |

96.40 |

97.10 |

0.70 |

0.77 |

0.25 |

0.00 |

0.04 |

0.09 |

0.13 |

|

|

TK-16-005 |

RJ Zone |

32.00 |

35.00 |

3.00 |

0.11 |

0.01 |

0.00 |

0.01 |

0.02 |

0.03 |

|

TK-16-006 |

Tyko Zone |

22.28 |

38.14 |

15.86 |

0.93 |

0.50 |

0.02 |

0.27 |

0.39 |

0.68 |

|

Including |

23.24 |

36.66 |

13.42 |

1.03 |

0.55 |

0.03 |

0.29 |

0.43 |

0.75 |

|

|

Including |

29.38 |

32.00 |

2.62 |

1.51 |

0.73 |

0.03 |

0.39 |

0.60 |

1.02 |

|

|

TK-16-007 |

Tyko Zone |

29.50 |

36.50 |

7.00 |

0.50 |

0.25 |

0.01 |

0.15 |

0.22 |

0.38 |

|

Including |

35.00 |

36.50 |

1.50 |

1.32 |

0.65 |

0.02 |

0.37 |

0.65 |

1.05 |

|

|

TK-16-008 |

Tyko Zone |

10.80 |

13.20 |

2.40 |

0.56 |

0.34 |

0.03 |

0.27 |

0.27 |

0.56 |

|

Including |

10.80 |

11.90 |

1.10 |

0.84 |

0.35 |

0.03 |

0.45 |

0.46 |

0.94 |

|

|

TK-16-009 |

No Significant Assays |

--- |

--- |

--- |

--- |

--- |

--- |

--- |

--- |

--- |

|

TK-10-010 |

Tyko Zone (Upper) |

7.00 |

15.00 |

8.00 |

0.84 |

0.39 |

0.03 |

0.25 |

0.31 |

0.59 |

|

Including |

13.00 |

14.00 |

1.00 |

2.52 |

0.90 |

0.03 |

0.83 |

0.77 |

1.62 |

|

|

Tyko Zone (Lower) |

49.93 |

56.15 |

6.22 |

1.06 |

0.35 |

0.02 |

0.29 |

0.34 |

0.65 |

|

|

Including |

52.60 |

53.47 |

0.87 |

4.71 |

0.82 |

0.02 |

1.36 |

1.17 |

2.55 |

|

|

TK-16-011 |

Tyko Zone |

8.75 |

14.80 |

6.05 |

1.47 |

0.49 |

0.03 |

0.23 |

0.45 |

0.71 |

|

Including |

11.65 |

14.80 |

3.15 |

2.12 |

0.48 |

0.02 |

0.28 |

0.64 |

0.94 |

|

|

TK-16-012 |

Bruce Lake |

31.80 |

46.00 |

14.20 |

0.14 |

0.01 |

0.00 |

0.01 |

0.01 |

0.02 |

|

TK-16-013 |

No Significant Assays |

--- |

--- |

--- |

--- |

--- |

--- |

--- |

--- |

--- |

|

TK-16-014 |

No Significant Assays |

--- |

--- |

--- |

--- |

--- |

--- |

--- |

--- |

--- |

*Previously released, see Nickel One news release April 12th 2016

**Reported widths are drilled core lengths, true widths are unknown at this time.

Figure 1: Tyko Project, 2016 Initial Drill Targets

Figure 2: Magma Conduit Model, RJ Zone, 2016 Initial Drill Targets.

QA/QC

The Nickel One drilling program was carried out under the supervision of Neil Pettigrew, M.Sc., P.Geo., VP, Fladgate Exploration Consulting Corporation and a Qualified Person as defined by NI 43-101, who reviewed and approved the technical content of this press release.

Samples were transported in secure bags directly from the Nickel One core handling facility in White River, Ontario, to the Accurassay Laboratories in Thunder Bay, Ontario. Accurassay, which is an accredited ISO/IEC 17025 lab, analysed the samples for PGEs using a 30 grams fire assay with an ICP-OES finish and for Ni, Cu, and Co using 0.25 grams by 4 acid digestion with ICP-OES finish. Ni, Cu and Co samples over 0.5 wt% were re-analysed using 2.5 grams by 4 acid digestion with ICP-OES finish. Check samples were sent to Act Labs in Thunder Bay, Ontario.

Certified standards, blanks and crushed duplicates are placed in the sample stream at a rate of one QA/QC sample per 20 core samples. Results are analyzed for acceptance at the time of import. All standards associated with the results in this press release were determined to be acceptable within the defined limits of the standard used.

About Nickel One: Nickel One Resources Inc. is a new base metal (copper, nickel) and precious metal (platinum, palladium, gold) exploration and development company evaluating the Tyko Property near Marathon, Ontario, Canada. Nickel One’s objective is to efficiently advance the Tyko Project through exploration and development to a mineral resource. The Company intends to build shareholder value through accretive acquisition of additional promising assets.

ON BEHALF OF THE BOARD:

President & CEO, Director

“Vance Loeber”

For further information contact:

Vance Loeber

Phone: 1778-327-5799 ext.315

Fax: 778-327-6675

Email: info@nickeloneinc.com

Neither the TSX Venture Exchange nor its Market Regulator (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This press release is not an offer or a solicitation of an offer of securities for sale in the United States of America. The common shares of Nickel One Resources Inc. have not been and will not be registered under the U.S. Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an applicable exemption from registration.

Information set forth in this press release may contain forward-looking statements. Forward-looking statements are statements that relate to future, not past events. In this context, forward-looking statements often address a company's expected future business and financial performance, and often contain words such as "anticipate", "believe", "plan", "estimate", "expect", and "intend", statements that an action or event "may", "might", "could", "should", or "will" be taken or occur, or other similar expressions. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, risks associated with project development; the need for additional financing; operational risks associated with mining and mineral processing; fluctuations in gold and other commodity prices; title matters; environmental liability claims and insurance; reliance on key personnel; the absence of dividends; competition; dilution; the volatility of our common share price and volume; and tax consequences to U.S. Shareholders. Forward-looking statements are made based on management's beliefs, estimates and opinions on the date that statements are made and the Company undertakes no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change. Investors are cautioned against attributing undue certainty to forward-looking statements.