Läntinen Koillismaa Project: PGE-Copper-Nickel

Finland

Location

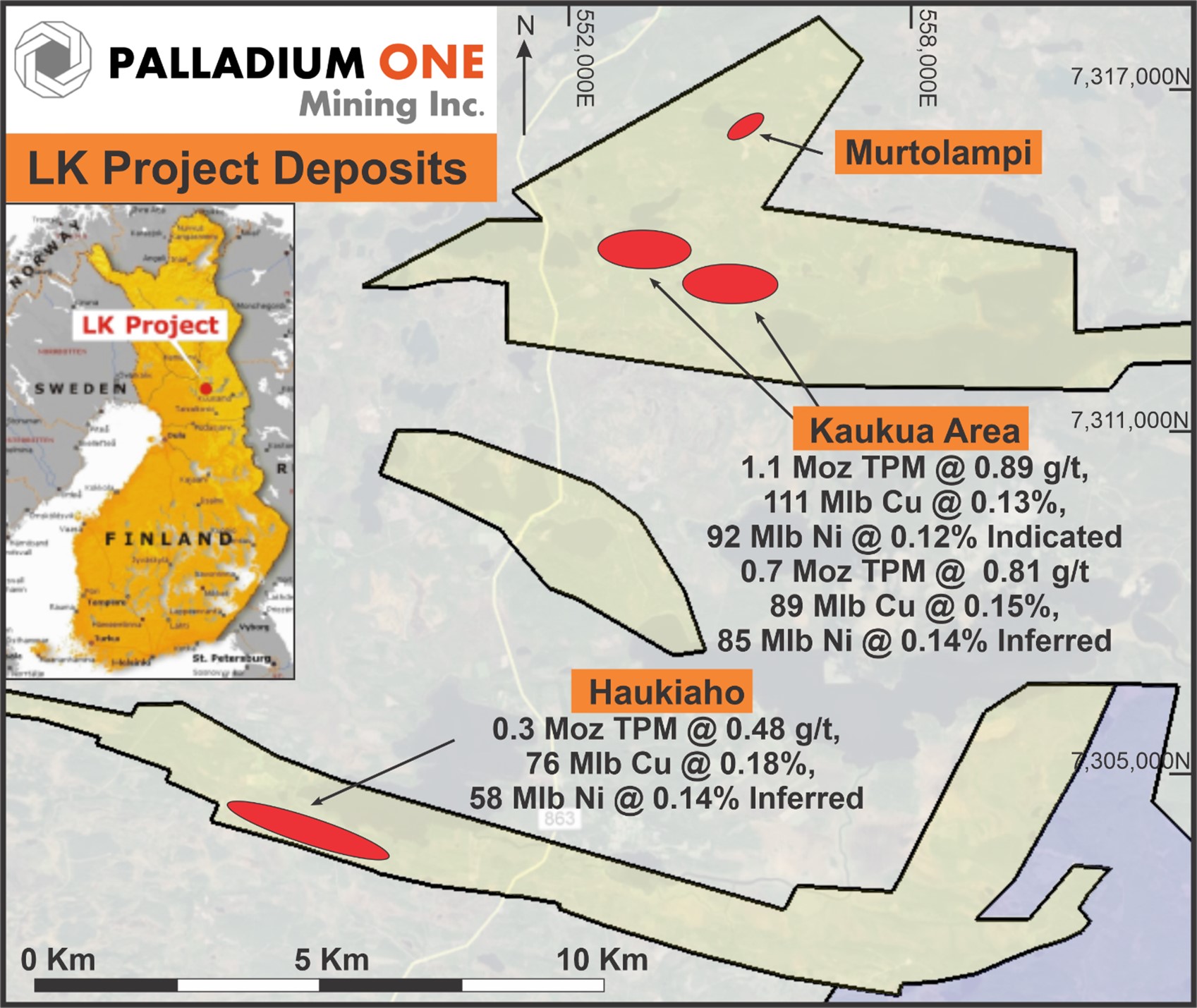

The palladium dominant Läntinen Koillismaa (“LK”) PGE-Ni-Cu project is located in north-central Finland, approximately 40 km north of the company’s exploration office in the town of Taivalkoski. The property is 160 km (by road) east-southeast of Rovaniemi and 190 km northeast of the port city of Oulu.

The LK Project is 100% owned by Palladium One Mining Inc.

Property Description

The LK Project is an exploration stage property being developed by Palladium One through its 100% owned Finnish entity Nortec Minerals Oy. The LK Project comprises the Kaukua, Kaukua South, Haukiaho, and Murtolampi deposit areas (Figure 1) that have been shown to be prospective for PGEs and base metals including nickel and copper.

The LK Project area is covered by Exploration Permit renewals, new applications, and Exploration Reservation applications. Exploration Permit applications are divided into two groups; the Kaukua Group consisting of the Kaukua and Murtolampi targets (Kaukua North 1-2) and the Haukiaho Group covering the Lipeävaara and Haukiaho targets; as well as Salmivaara, which represents the eastern and western extension of Haukiaho.

The exploration permit applications cover 2,485.3 hectares, while the Exploration Reservation applications cover 1,351.5 hectares

None of the permit areas are located on nature conservation areas, however, the Exploration Permit application for Salmivaara 2-11 has approximately 2.3 km of common border with a Natura 2000 area. Natura 2000 is a nature conservation program established according to Finnish national legislation and in accordance to a directive given by the European Union.

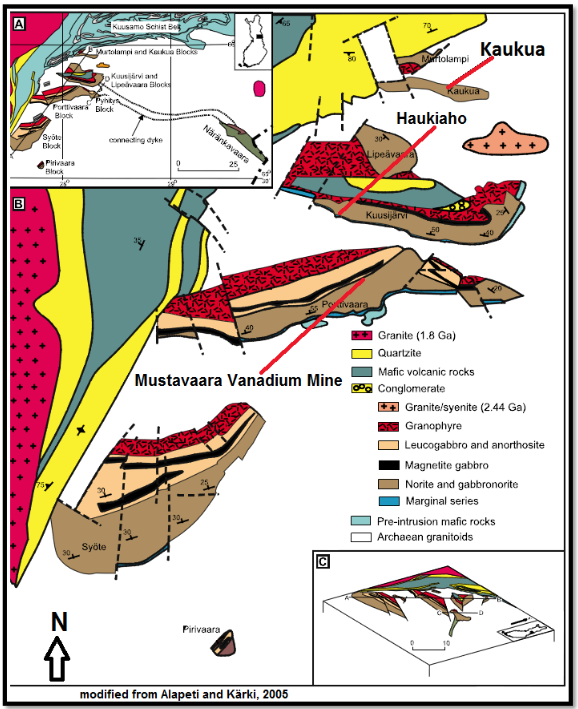

Mineral Resource Estimate – April 2022

The geological setting of the deposit is well understood, informed through geological mapping, sampling, geophysical surveying, and regional exploration drilling. The LK Project in north-central Finland is hosted within the Paleoproterozoic, rift-related Koillismaa Layered Igneous Complex (Koillismaa Complex) of the regional Tornio-Näränkävaara intrusion belt (TNB) of north-central Finland consisting of the Näränkävaara Intrusion in the east and the Koillismaa Complex in the west. The Kaukua deposit is hosted within the northern part of the Koillismaa Complex and the Haukiaho deposit is situated 12 km south-southwest from Kaukua, also in the Koillismaa Complex.

The main sulphide minerals are pyrrhotite, chalcopyrite, and pentlandite. The sulphide assemblage occurs as fine to medium grained dissemination, disseminated aggregations, and blebs. Haukiaho mineralization resembles Kaukua geologically and mineralogically and is likely to have the same origin, however, it is more sulphide Cu-Ni rich than Kaukua and includes local narrow massive sulphide veins.

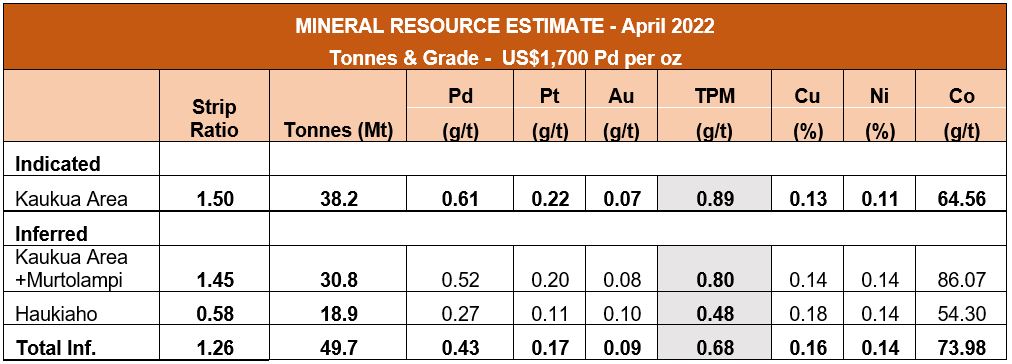

Mineral Resources at the LK Project conform to CIM (2014) definitions.

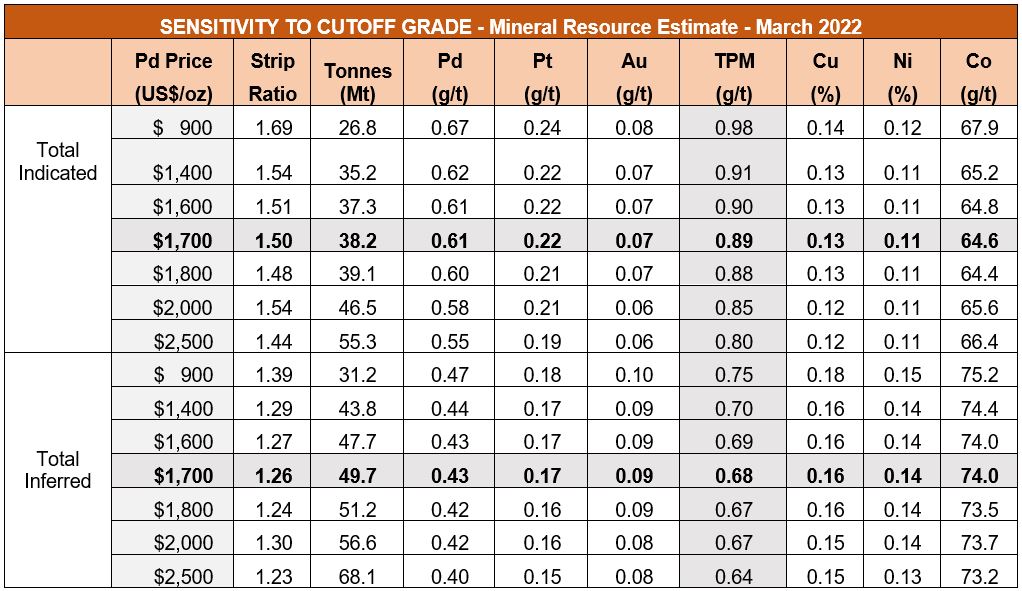

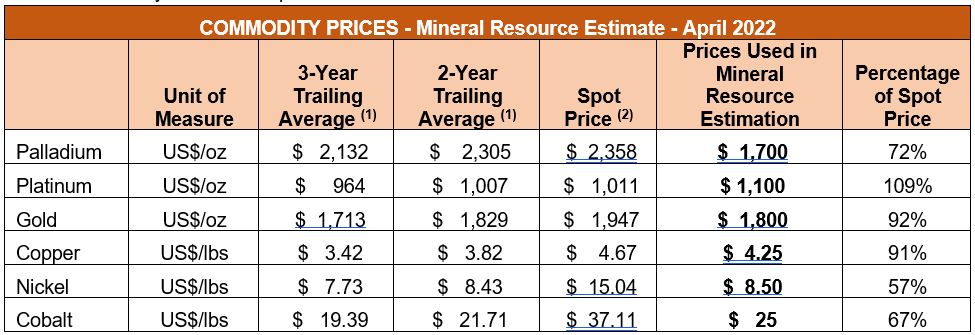

The LK Project Mineral Resources were estimated by Palladium One and audited by SLR. Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Standards for Mineral Resources and Mineral Reserves dated May 10, 2014 (CIM (2014) definitions) were used for Mineral Resource classifications. In addition to the Mineral Resource Estimate (“MRE”) which used US$1,700/oz palladium (Table 1a, 2b), a sensitivity analysis was completed with seven optimized open-pit constrained resource estimates, with palladium prices ranging from US$900/oz to US$2,500/oz (Table 2a, 2b).

As of April 25, 2022, The MRE provides the following highlights:

- 1.1 million ounces Total Precious Metals (Pd+Pt+Au) (“TMP”) (0.89 g/t), 111 Million Pounds Copper (0.13%), 92 Million Pounds Nickel (0.11%) and 5 million Pounds Cobalt (65 g/t) are classified as Indicated, contained in 38.2 million tonnes (see Table 1b).

- 1.1 million ounces TMP (0.68 g/t), 173 Million Pounds Copper (0.16%), 152 Million Pounds Nickel (0.14%) and 8 million Pounds Cobalt (74 g/t) are classified as Inferred, contained in 49.7 million tonnes (see Table 1b).

- 248% increase in Indicated tonnes and a 14% increase in Inferred tonnes.

- 44% of the MRE is in the Indicated category.

- The MRE assumes a Net Smelter Return (“NSR”) cut-off of US$12.50 per tonne, based on a 20,000 tonne per day milling rate.

- Includes three open-pits in the Kaukua Area (including Murtolampi) and one at Haukiaho, 10-kilometers to the south of Kaukua.

- Recovered, and payable metal assumptions are based on the 2022 Phase II Metallurgical Testing Program, and preliminary indicative copper and nickel smelter quotes.

Table 1b. 2022 LK MRE In-situ contained metal

CIM (2014) definitions were followed for Mineral Resources.

- The Mineral Resources have been reported above a preliminary open pit constraining surface using a net smelter return (NSR) pit discard cut-off of US$12.5/t (which, for comparison purposes, equates to an approximately 0.65 g/t palladium equivalent (PdEq) in-situ cut-off grade, based on metal prices only).

- The NSR used for reporting is based on the following:

- Long term metal prices of US$1,700/oz Pd, US$1,100/oz Pt, US$1,800/oz Au, US$4.25/lb Cu, US$8.50/lb Ni, and US$25/lb Co.

- Variable metallurgical recoveries for each metal were used at Kaukua and Murtolampi and fixed recoveries of 79.8% Pd, 80.1% Pt, 65% Au, 89% Cu, 64% Ni, and 0% Co at Haukiaho.

- Commercial terms for a Cu and Ni concentrate based on indicative quotations from smelters.

- Total Precious Metals (TPM) equals palladium plus platinum plus gold.

- Bulk densities range between 1.8 t/m3 and 3.23 t/m3.

- Numbers may not add up due to rounding.

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues.

- The quantity and grade of reported Inferred Mineral Resources in this estimation are conceptual in nature and there has been insufficient exploration to define these Inferred Mineral Resources as an Indicated or Measured Mineral Resource and it is uncertain if further exploration will result in upgrading them to an Indicated or Measured Mineral Resource category.

Table 2a. 2022 LK MRE Sensitivity to Palladium Price - Grade

Notes:

- Total Precious Metals (TPM) equals palladium plus platinum plus gold

- Only the Palladium Price is varied, all other commodity prices remained fixed at the 2022 MRE price deck

- Each Palladium price point is tabulated using a conceptual pit specific to that price point

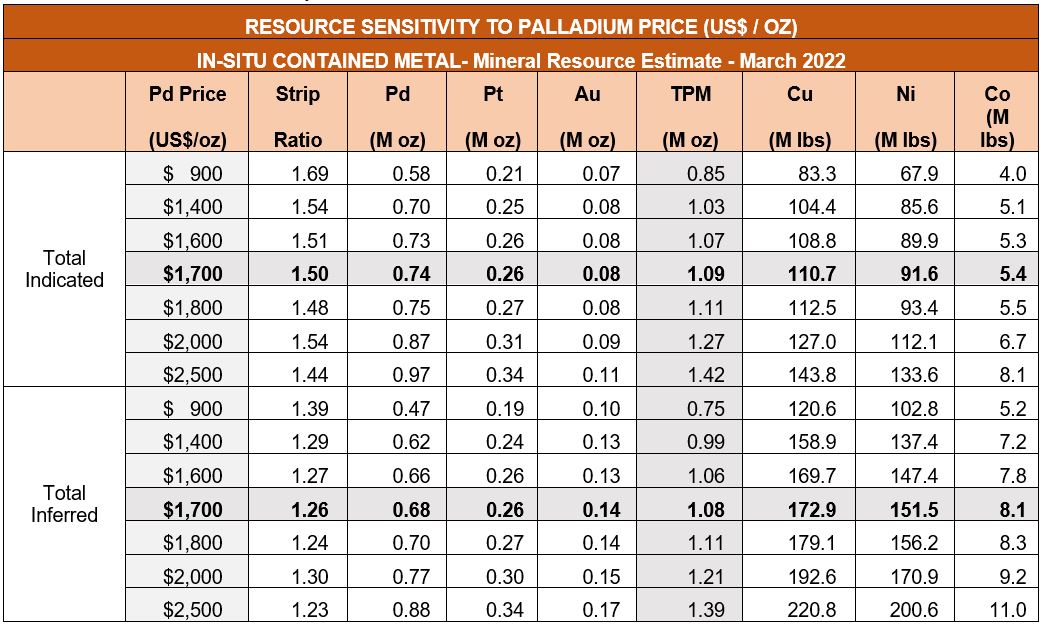

Table 2b. 2022 LK MRE Sensitivity to Palladium Price - contained metals

Notes:

- Total Precious Metals (TPM) equals palladium plus platinum plus gold

- Only the Palladium Price is varied, all other commodity prices remained fixed at the 2022 MRE price deck

- Each Palladium price point is tabulated using a conceptual pit specific to that price point

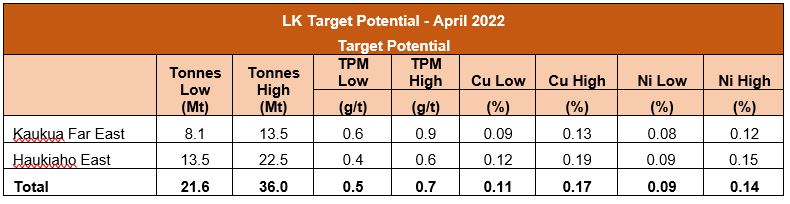

Table 3. 2022 LK Target Potential

Table 4. Commodity Price Assumptions used in the MRE

(1) Source: As of April 19, 2022. As quoted on the LBMA & LME for precious & base metals, respectively.

(2) Source: S&P Capital IQ. 2026 estimates used as a proxy.

Regional Geology of the Koillismaa Layered Igneous Complex

The KLIC of north central Finland is part of the 2.5-2.4 Ga Fennoscandian Early Palaeoproterozoic layered complexes that were emplaced as part of a globally recognized episode of igneous activity that introduced layered intrusions and mafic dyke swarms worldwide.

These igneous formations have been found to have potential for Cr, Cu-Ni-PGE sulphide, PGE and Fe-Ti-V oxide mineralization. Examples of well-known economic deposits of these types are the ones hosted by the South- African Bushveld, Russian Monchegorsk and Finnish Tornio-Näränkävaara belt of intrusions (Iljina and Hanski 2005).

The KLIC makes up the eastern most portion of the TNB and consists of two main sectors, the Näränkävaara Intrusion in the east and the Western Intrusion. These two intrusions are likely connected by an unexposed connecting dyke, which is indicated by a strong magnetic and gravity anomaly (Alapieti, 1982).

The Western Intrusion is thin despite its greater surface area with an average vertical thickness for the three major blocks of only 1-3 km, but the exposed igneous stratigraphy is as much as 3 km. The Western Intrusion is overlain with felsic volcanic rocks that have recrystallized to form a granophyre unit up to 1 km in thickness. In contrast, the footwall granite gneisses at the base of the intrusion have been partially melted and pervasively metasomatically altered to albite-quartz rock. Gabbroic igneous rocks, chemically different than the layered sequence, form the footwall locally such as underneath the Porttivaara, Tilsa, and Kaukua Blocks.

The Western Intrusion has been uplifted and broken into a number of blocks due to multiphase tectonic events. The Western Intrusion has been folded slightly and possibly even collapsed during the earliest, extensional, tectonic regime to form a synclinal structure between the Kuusijärvi and Lipeävaara Blocks (Karinen, 2010). The supracrustal sequence deposited along this structure is known as the Kuusijärvi synform. The igneous layering of the intrusive blocks to the south of the synform, dips to the north, (Tilsa to the NW) while the northern blocks dip to the south (Kaukua and Murtolampi).

The cumulus stratigraphy of the Western Intrusion is divided into the Marginal Series and the overlying Layered Series. The Marginal Series can be up to a couple of hundred metres in thickness and be made up of differentiated cumulates ranging from gabbros and pyroxenites to peridotites. The Marginal Series can be repeated on surface due to tectonic movements at Porttivaara and Tilsa Blocks, in particular. The Layered Series is composed entirely of mafic cumulates.

Access

The LK Property is located in the municipality of Posio, Finland between the towns of Posio and Taivalkoski. All target areas are accessible by public roads and private roads. Public roads (paved or gravel) are kept open all year round and the private gravel roads are maintained only during periodic logging activities. The main road between Posio and Taivalkoski is paved.

Local Resources and Infrastructure

The LK Project is an exploration stage project and therefore there is no existing mining related infrastructure.

All target areas are accessible by public and private roads, and the property is accessible year-round from airports in Oulu, Rovaniemi, and Kuusamo, which are approximately 190 km, 160 km, and 90 km by road from the property areas, respectively. There are regular flights to these airports from the Finnish capital, Helsinki.

Sources of power, water, and personnel are available locally and are sufficient for proposed exploration activities. Water is readily available from sources in proximity to the properties, however, permission must be obtained to use it. High voltage power lines cross the Haukiaho and Lipeävaara properties and run 4.5 km from the western side of the Kaukua mineralized body.

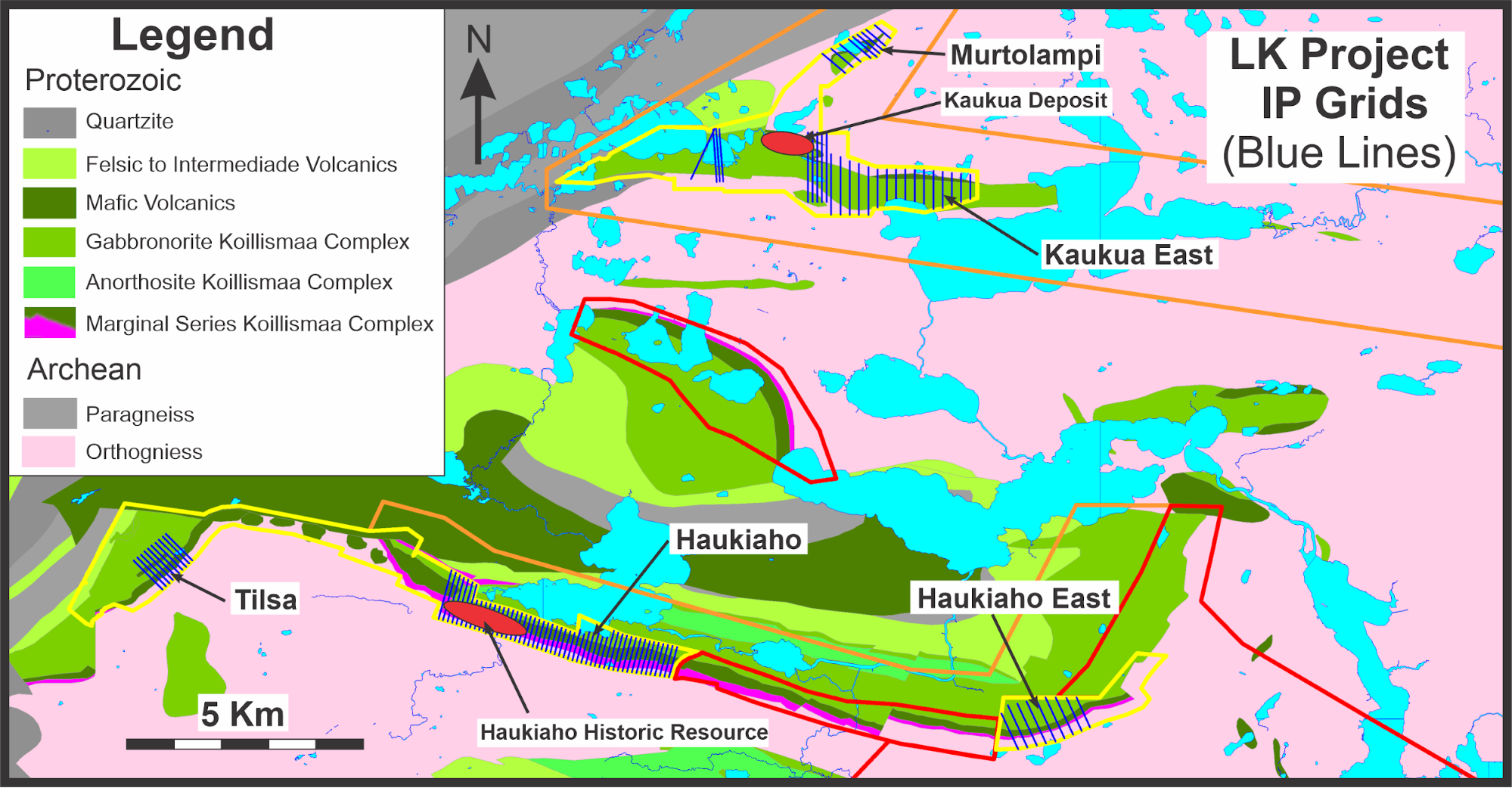

Future Resource Expansion

LK remains open for additional resource expansion both along strike and at depth.

- The MRE covers approximately 5 kilometers of the 38-kilometer marginal series contact zone, for which reconnaissance historical drilling indicated mineralization along nearly it’s entire length.

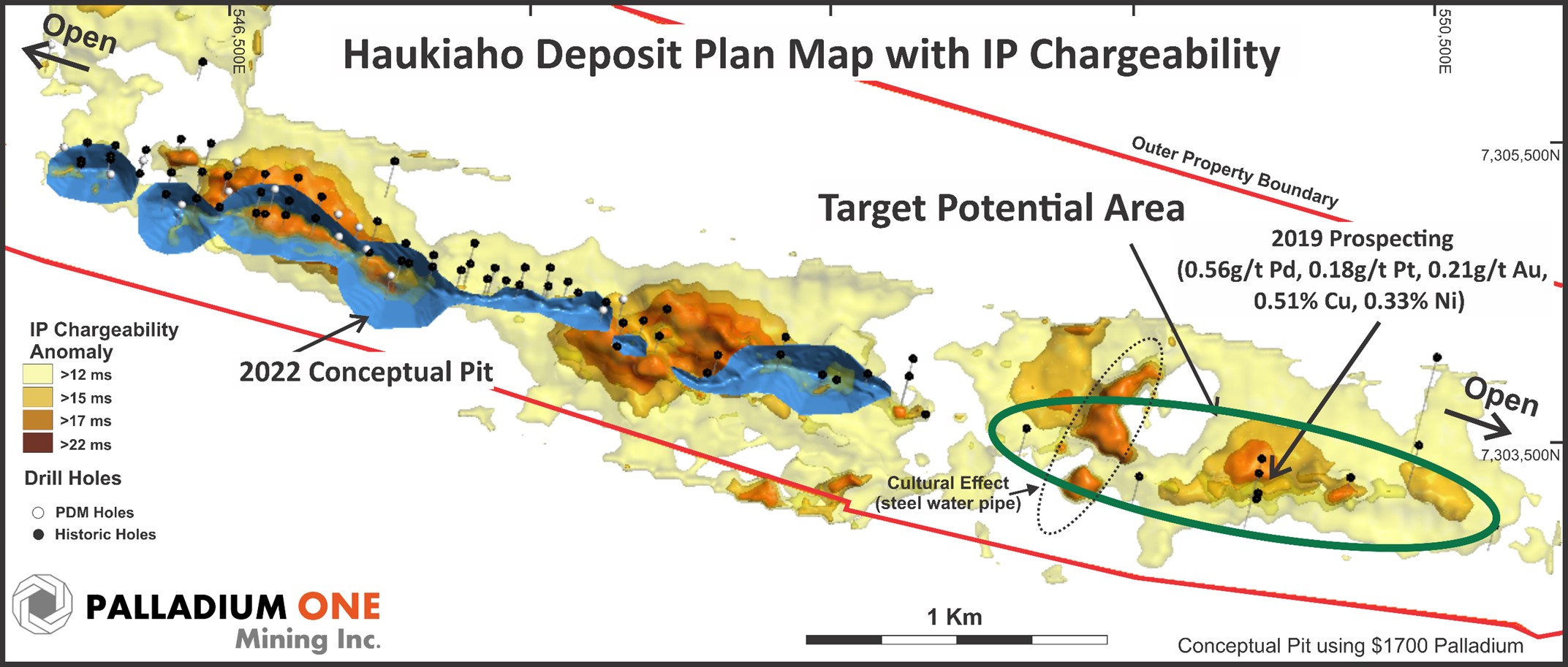

- The Company’s near-term targeting includes two additional open-pit targets in the Kaukua Area and possibly multiple open-pit targets along the 17-kilometer Haukiaho Trend.

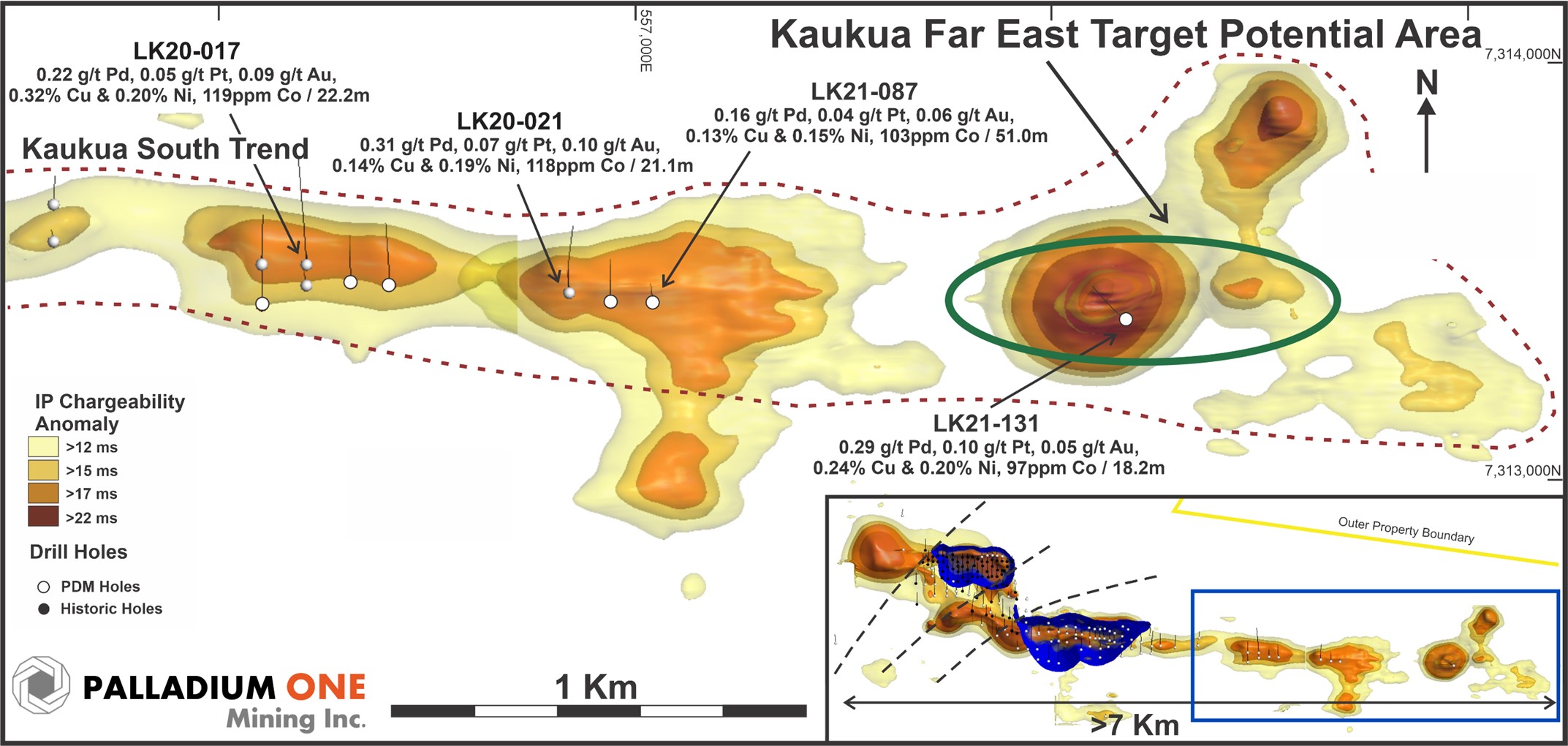

- Three areas of Target Potential have been defined for near term resource expansion representing an additional 2.4-kilometer of strike length along the favourable marginal series and could add between 21.6 million and 36.0 million tonnes of resource. Refer to Table 3, Figures 2 & 3

Figure 2. Kaukua Area showing eastern extension of the Kaukua South trend with Target Potential areas outlined in green.

Figure 3. Huakiaho area with current conceptual open pit (blue) and Target Potential areas outlined in green.

Technical Information and Qualified Person

The SLR Qualified Persons (QP) for the Technical Report published with the above MRE data are Sean Horan, P.Geo., Technical Manager, and Brenna J.Y. Scholey, P.Eng., Principal Metallurgist.

Discussions were held with personnel from Palladium One, including:

- Mr. Neil Pettigrew, M.Sc., P. Geo., Vice President of Exploration, Director, Palladium One

- Mr. Alex Whaley, P. Geo., Exploration Manager, Fladgate Exploration Corp.

- Mr. Eelis Räme, Project Geologist, Geoconsulting Oy.

- Dr. Markku Iljina, EurGeol., Owner and President, Geoconsulting Oy.

- Mr. David Thomas, P. Geo., Mineral Resource Geologist and Owner of DKT Geosolutions Inc.

Mr. Horan and Ms. Scholey are independent QPs as defined in NI 43-101.